Manufacturers rarely fail because of a lack of ideas. The challenge is deciding which projects deserve investment when portfolios span multiple divisions and departments.

Engineering tracks technical wins. Operations models manufacturing costs. Finance focuses on ROI. Sourcing highlights savings. Each team is right — but without a consistent financial model, leadership is left comparing apples to oranges.

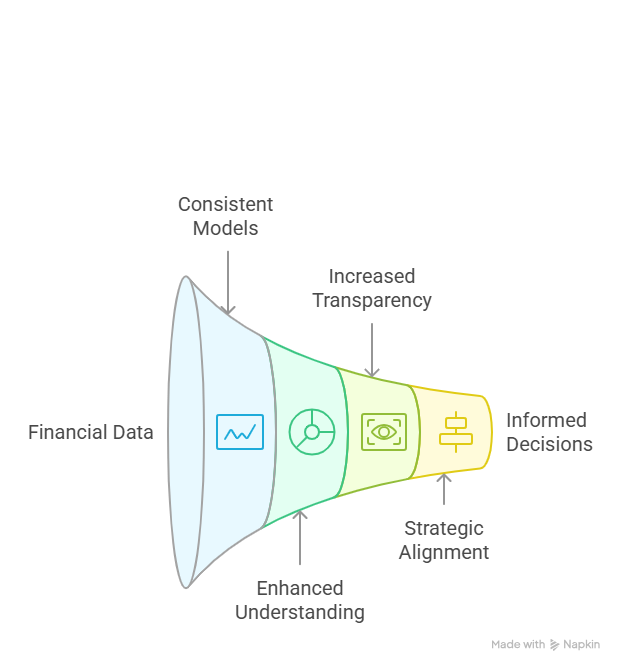

That’s where a standardized financial framework makes all the difference. For more than a decade, we’ve helped manufacturers manage thousands of project financial models worldwide. The result is clarity, comparability, and confidence in portfolio decisions.

Why Financial Consistency Matters

When each project uses its own assumptions, leadership can’t see the real trade-offs:

- A sourcing project may save millions, but look “less strategic” because savings aren’t modeled.

- A product launch might look profitable, but CapEx is buried in operating costs.

- One division’s NPV calculation is not comparable to another’s.

Without consistency, portfolios drift into politics instead of strategy.

The Foundation: A Unified Financial Model

Every project should use the same framework, capturing:

- Fixed and variable product costs

- Pricing and revenue assumptions

- External expenses (broken into comparable categories)

- Capital expenditures (CapEx)

- Non-product sales (licensing, services, fees)

- Sourcing savings and cost avoidance

From this, projects can be compared on two common metrics: Net Present Value (NPV) and payback period.

From Projection to Actuals

Financial models are not static. They begin as projections, but as projects move through stages, actuals should be loaded in:

- Expense tracking replaces estimates

- Revenue assumptions are tested against reality

- Sourcing savings are proven, not promised

This dynamic view gives leadership both a forecast and a current state, ensuring portfolios are steered by facts, not outdated spreadsheets.

Seeing the Full Picture

Not every leader views financials the same way. Some need a fully burdened cost view. Others look to contribution margin to judge profitability.

Both matter.

- Fully burdened costs reveal the all-in financial commitment.

- Contribution margin shows incremental profitability.

When both lenses are available, leadership sees the complete impact of each project.

The Transformation: Before vs After

Before

- Divisions model projects differently.

- ROI looks inflated because CapEx is hidden.

- Savings projects are undervalued.

- Projections never match reality.

- Portfolio decisions are driven by politics.

After

- Every project follows a common financial framework.

- CapEx, OpEx, and external expenses are separated.

- Sourcing savings are valued as profit.

- Projections evolve into actuals.

- Projects can be compared apples-to-apples across the entire portfolio.

Turning the Dials

Consistent financials give leadership the ability to “turn the dials” on strategy across the whole enterprise:

- Emphasize growth by prioritizing projects with strong revenue and short payback.

- Invest in savings by elevating sourcing initiatives that directly impact margin.

- Drive innovation by funding projects with higher risk but long-term NPV.

- Balance divisions by applying the same financial lens across engineering, operations, sourcing, and business units.

Final Thoughts

Financial consistency is the common language of project portfolios. It transforms project comparisons from messy debates into strategic decisions.

At KMD Technology Solutions, we help manufacturers integrate financial models into KMDProjects, so portfolios are aligned, comparable, and always grounded in reality.

📌 Ready to stop comparing apples to oranges in your portfolio? Request a demo and see how consistent financial models give leadership the clarity to invest with confidence.